Your Trusted Partner for Hassle-Free Tax Solutions in Japan

CONCEPT

Welcome to MOVE ON – We are here for Everyone living in Japan!

MOVEON's goal is clear: to continually provide energy to customers who are challenging themselves in the business world in Japan. Being a business owner is like mixed martial arts; you need to juggle three things simultaneously: 1) Letting competitors win, 2) Maintaining your products or services at your ideal level, and 3) Managing the best way to sell your products or services to customers. We understand that you are taking on these three challenges. However, there is one more crucial thing: managing your finances. Business doesn't stop because it's in the red; it stops when there's no money left. We exist to allow you to focus on the top three.

Our appointed team of experts will handle all your tax-related tasks so you can truly concentrate on the above three. What sets us, MOVEON, apart from other accounting firms? It's our experience in supporting these three amidst the changes in the business environment, which we take pride in. We don't just provide tax services; we act based on the pride of supporting your challenges. Our vision is to take care of the business background, so you can stay focused on your challenges.

Our team values empathy and mutual understanding with our customers. Let me reiterate, we're not just an accounting firm. We are your business partner in your challenges. Your success is our pride, and we work tirelessly every day, using it as energy for our business to thrive. We aim to support you in the background of your business, especially in the financial field, so you can achieve success in your business

Choose MOVEON to benefit your business. With us, you can invest your most valuable asset as a business owner, 'time,' into what you do best. We'll speed up your business growth, turning your efforts into more success and setting you apart from competitors.

Let's take on these challenges together by experiencing what MOVE ON can do for you.

Your success story begins here!

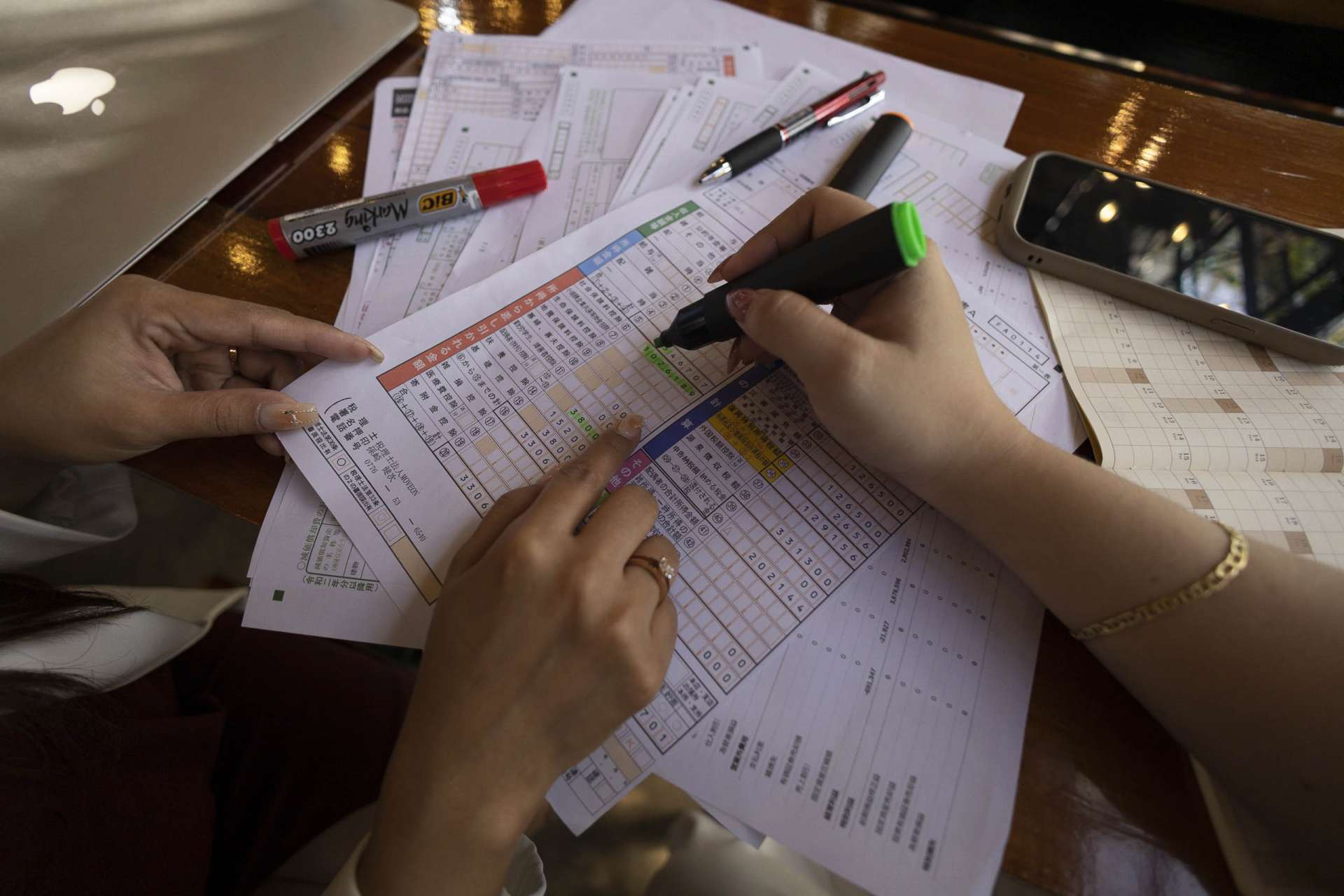

We offer tax services for everyone in Japan!

SERVICE

MOSTLY FREQUENLY ASK QUESTION FROM OUR CLIENT

Q&A

- What is a tax refund, and who can claim it?

- A tax refund is the return of excess taxes you’ve paid to the Japanese government. Everyone in Japan regardless their visa type, can claim refunds if they have overpaid taxes or qualify for deductions they didn’t initially apply for

- How do I know if I am eligible for a tax refund?

- Eligibility depends on factors such as your income, and tax contributions. Our team will review your records to determine if you qualify and help you claim what you’re entitled to.

- How long does it take to process a tax refund?

- Once submitted, it can take 1-2 months for the Japanese tax authorities to process your claim. We will assist in ensuring your documents are accurate to avoid delays.

- What happens if I miss the tax filing deadline?

- Missing the deadline may result in penalties or fines. It's important to stay compliant with Japan's tax laws. Our team can assist you with timely filing and ensure you avoid unnecessary penalties.

- What taxes do I need to pay as a business owner in Japan?

- Business owners in Japan are required to pay several types of taxes depending on which category they fall in, including corporate tax, consumption tax, and local inhabitant taxes. Sole proprietors must also file income taxes.

- How can I reduce my business tax burden legally?

- You can reduce your tax burden by utilizing deductions, such as expenses for business operations, employee salaries, and equipment purchases. MOVEON provides detailed tax planning strategies to help you optimize your tax payments

- What is a pension lump sum withdrawal?

- A pension lump sum withdrawal is a one-time payment you can claim when leaving Japan if you have contributed to the Japanese pension system for at least six months. It allows you to recover a portion of the pension contributions you made while working in Japan.

- Who is eligible to claim a pension lump sum withdrawal?

- Foreign nationals who are leaving Japan permanently, have contributed to the Japanese pension system, and apply within two years of leaving the country are eligible.

Where we keep you track on latest tax news!

SOCIAL MEDIA

Follow Our Social Media Channels for Updates

Kenji Magosaki, CEO of MOVEON Tax Accountant Corporation and MUSCLE and MONEY General Incorporated Association , and Liezel Jane Nakagawa, manager of the Philippine department, work together to educate and empower individuals and businesses navigating Japan's tax system. Through their social media channels, Kenji shares expert insights on Japanese tax laws and regulations, while Liezel focuses on simplifying tax complexities for the Filipino community, providing practical guidance and tailored solutions.

Access to our consultation with tax professionals!

ACCESS

MUSCLE and MONEY is a trusted organization dedicated to helping foreign business owners in Japan, especially Filipinos, with all their tax, pension, and financial needs. We simplify complex processes like tax refunds, pension lump-sum claims, and document translations, ensuring our clients can focus on growing their businesses and achieving their goals. We provide personalized support to meet your unique needs, giving you peace of mind and confidence in managing your finances in Japan.