What is Income Tax Refund in Japan?

Income tax refund is a procedure that allows you to apply for and recover overpaid taxes. You can receive a refund if deductions or tax exemptions are not reflected correctly when filing your annual income tax return, or if various deductions are not declared.

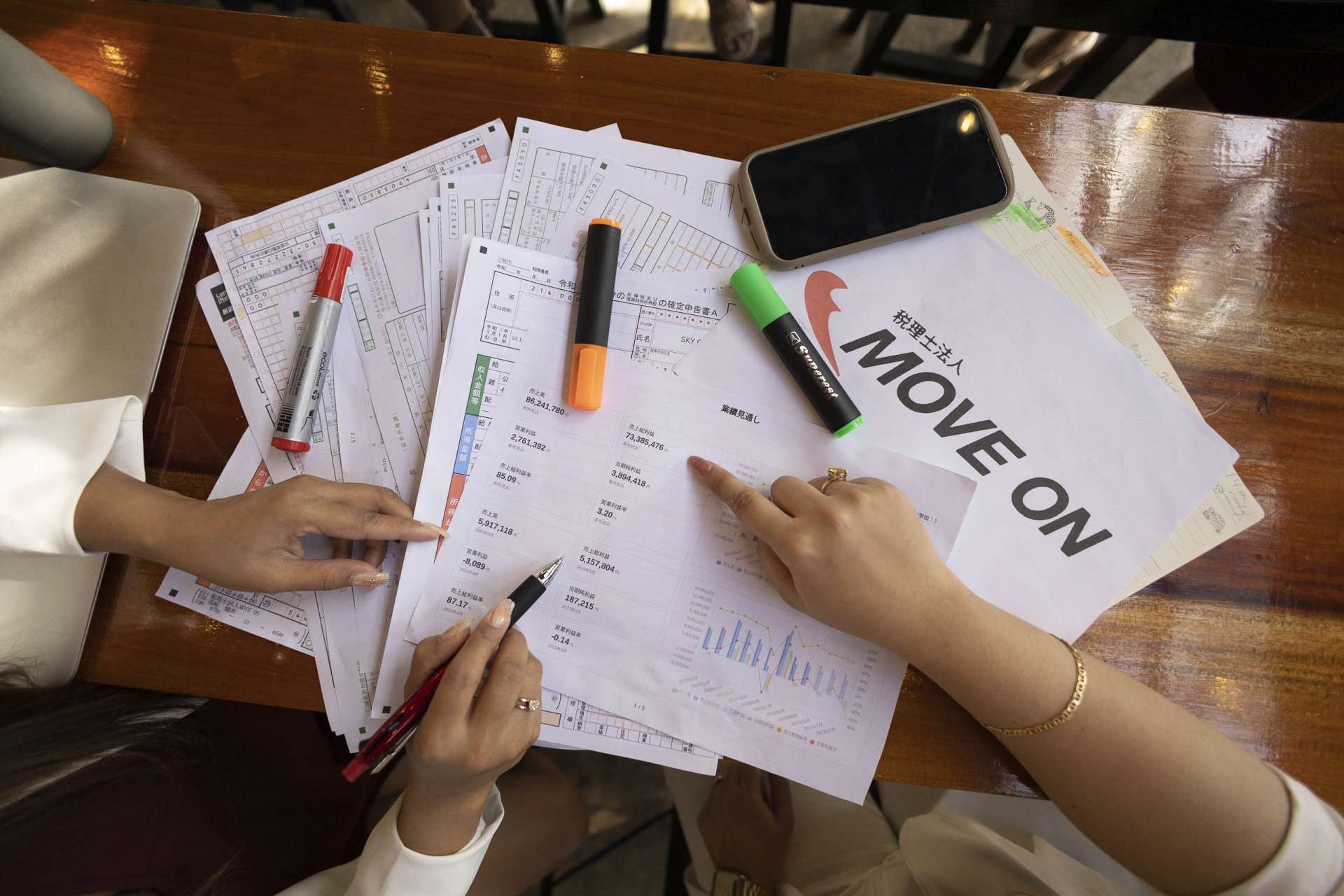

Our company will support you with the procedures related to income tax refund applications.

We have experienced tax accountants that will calculate the optimal refund amount and carry out the procedure accurately and quickly.

Why Choose Us?

Expertise in Japanese Tax Laws and Regulations

Our team of expert and experienced tax professionals stays up to date with the latest Japanese tax laws and regulations. We are well-equipped with the knowledge to deal with the complexities of Japan's tax system and provide accurate and compliant tax documentation services.

Dedicated Filipino Client Support

We recognize that Japan’s tax regulations and procedures can be complex, especially for OFWs. To better serve you, our team includes dedicated Filipino staff who can assist you in your native language, ensuring clear and effective communication. We are committed to helping you navigate the process smoothly, understanding the requirements, and identifying any potential tax benefits or refunds you're entitled to. With our support, you can confidently manage your taxes while focusing on your life and work in Japan.

Comprehensive Income Tax Services

Our company provides a full range of income tax refund services tailored to meet the unique needs of employees, sole proprietors, and business owners. Whether you're managing personal finances or overseeing a business, our expert team is here to help you recover any overpaid taxes efficiently and accurately.

Personalized Approach

We believe that building strong relationships with our clients, based on trust and transparency, is of the utmost importance. Our tax professionals take the time to thoroughly understand your unique circumstances and financial goals. Throughout the entire tax preparation process, we provide personalized services, addressing all your questions and concerns to ensure you feel supported every step of the way.

Reliable and Confidential Service

At our company, the confidentiality and security of your personal information are our top priorities. We implement strict measures to safeguard your data, ensuring that all personal and financial information is handled with the highest level of confidentiality and care. You can trust us to protect your privacy while delivering reliable tax services.

Our Income Tax Refund Service

Calculation of Refund Amount: We thoroughly assess your income and eligible deductions to calculate the total refund amount.

Preparation of Tax Returns: We prepare the necessary documents for submission to the tax office and manage the entire process on your behalf.

Who can avail for Income Tax Refund?

Individuals Who Missed Deductions During Year-End Adjustments

If you did not claim deductions such as dependent exemptions, spouse exemptions, or life insurance premium deductions during year-end adjustments, you may have overpaid taxes.

Those Eligible for Medical Expense Deductions

If your annual medical expenses exceeded ¥100,000, you can apply for medical expense deductions.

Homeowners who have not applied for House Loan Deductions

If you have loan a house but have yet to apply for house loan deductions, or if you have missed deductions, our support can help you complete the necessary procedures to secure your refund.

Individuals with Undeclared Life Insurance Premiums

If you have life insurance policies but have not declared the premiums for deductions, you could be overpaying your taxes. By declaring these premiums, you may qualify for significant tax reductions.

Our Service Fee for Income Tax Refund

In this service, we first collect your primary requirements to assess your eligibility for a refund. Once we have reviewed your documents, we will calculate the estimated refund amount and provide you with our service fee. At that point, you are free to decide whether to proceed with our services or not. This ensures you have all the information needed to make an informed choice without any obligation.

Contact Us

For any questions or inquiries regarding refunds, please feel free to reach out to us at any time.

Our dedicated staff is here to assist you with care and professionalism.